Both mortgage interest rates and home prices are projected to rise throughout 2019. If you plan on buying a home this year, the time is now! Let’s get together to discuss your plans today! 208-919-3248

4 Reasons to Sell This Summer [INFOGRAPHIC]

Some Highlights:

- Buyer demand continues to outpace the supply of homes for sale. This means that buyers are often competing with one another for the few listings that are available.

- Housing inventory is still under the 6-month supply needed to sustain a normal housing market.

- Now may be the time for you and your family to move on and start living the life you desire!

Having a Professional on Your Side Makes All the Difference!

In today’s fast-paced world where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, the addition of more information causes more confusion.

Shows like Property Brothers, Fixer Upper, and dozens more on HGTV have given many a false sense of what it’s like to buy and sell a home.

Now more than ever, you need an expert on your side who is going to guide you toward your dreams and not let anything get in the way of achieving them. Buying and/or selling a home is definitely not something you want to DIY (Do It Yourself)!

Here are just some of the reasons you need a real estate professional in your corner:

There’s more to real estate than finding a house you like online!

There are over 230 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you achieve your dream?

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

What is the home you’re buying or selling worth in today’s market?

There is so much information on the news and on the Internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low ball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

Today’s real estate market is highly competitive. Having a professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage!

Top 5 Reasons You Shouldn’t FSBO

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.

Here are the top five reasons:

1. Exposure to Prospective Buyers

According to the 2017 Profile of Home Buyers and Sellers from NAR, last year 95% of buyers search online for a home. That is in comparison to only 15% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?

2. Results Come from the Internet

Where did buyers find the home they actually purchased?

- 49% on the internet

- 31% from a Real Estate Agent

- 7% from a yard sign

- 1% from newspapers

The days of selling your house by just putting up a sign and putting it in the paper are long gone. Having a strong internet strategy is crucial.

3. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale by Owner:

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house

- The appraiser if there is a question of value

4. FSBOing Has Become More And More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

5. You Net More Money When Using an Agent

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything, and in some cases, may be costing themselves more, by not listing with an agent. One of the main reasons for the price difference at the time of sale is:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

If more buyers see a home, the greater the chances are that there could be a bidding war for the property. The study showed that the difference in price between comparable homes of size and location is currently at an average of 6% this year.

Why would you choose to list on your own and manage the entire transaction when you can hire an agent and not have to pay anything more?

Bottom Line

Before you decide to take on the challenges of selling your house on your own, let’s get together to discuss your needs.

Home Inspections: What to Expect

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. Oftentimes, agents make your offer contingent on a clean home inspection.

This contingency allows you to renegotiate the price you paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.

How to Choose an Inspector

Your agent will most likely have a short list of inspectors that they have worked with in the past that they can recommend to you. HGTV recommends that you consider the following 5 areas when choosing the right home inspector for you:

-

-

- Qualifications – find out what’s included in your inspection and if the age or location of your home may warrant specific certifications or specialties.

- Sample Reports – ask for a sample inspection report so you can review how thoroughly they will be inspecting your dream home. The more detailed the report, the better in most cases.

- References – do your homework – ask for phone numbers and names of past clients who you can call to ask about their experiences.

- Memberships – Not all inspectors belong to a national or state association of home inspectors, and membership in one of these groups should not be the only way to evaluate your choice. Membership in one of these organizations often means that continued training and education are provided.

- Errors & Omission Insurance – Find out what the liability of the inspector or inspection company is once the inspection is over. The inspector is only human after all, and it is possible that they might miss something they should have seen.

-

Ask your inspector if it’s okay for you to tag along during the inspection, that way they can point out anything that should be addressed or fixed.

Don’t be surprised to see your inspector climbing on the roof or crawling around in the attic and on the floors. The job of the inspector is to protect your investment and find any issues with the home, including but not limited to: the roof, plumbing, electrical components, appliances, heating & air conditioning systems, ventilation, windows, the fireplace and chimney, the foundation, and so much more!

Bottom Line

They say ‘ignorance is bliss,’ but not when investing your hard-earned money into a home of your own. Work with a professional who you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase.

Selling Your House: Here’s Why You Need A Pro In Your Corner!

With home prices on the rise and buyer demand still strong, some sellers may be tempted to try to sell their homes on their own rather than using the services of a real estate professional.

Real estate agents are trained and experienced in negotiation while, in most cases, the seller is not. Sellers must realize that their ability to negotiate will determine whether or not they get the best deal for themselves and their families.

Here is a list of just some of the people with whom the seller must be prepared to negotiate if they decide to For Sale by Owner (FSBO):

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interests of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house

- The termite company, if there are challenges

- The buyer’s lender, if the structure of the mortgage requires the sellers’ participation

- The appraiser, if there is a question of value

- The title company, if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality, if you need to get the CO permits mentioned above

- The buyer’s buyer, in case there are challenges with the house your buyer is selling

Bottom Line

The percentage of sellers who have hired real estate agents to sell their homes has increased steadily over the last 20 years. Let’s get together to discuss all that we can do to make the process of selling your house easier for you.

The Enormous Divide Between the Headline and the Truth

“I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” – John Stuart Mill (1840s)

Even back in the mid-1800s, people knew that negative news sells. That is still true today. All forms of media realize that they will get more eyeballs, clicks, likes, and engagement by posting something negative. However, they must realize that negative headlines impact markets.

Just last week, the National Association of Home Builders released a survey revealing:

“Negative media reports making buyers cautious was a significant problem for 48% of builders in 2018, but 62% expect it to be a problem in 2019.”

Even today, good news is headlined with a negative spin in order to get attention. Here are two recent examples from mainstream media:

Actual Headline #1: Cash-out refis are back – will homes become ATMs again?

The real story: The headline is accurate – to a point. It is true that the percentage of refinances in which the homeowner received cash at the closing has increased to levels that existed in 2006. However, the actual amount of equity homeowners “cashed-out” compared to a decade ago isn’t close.

The dollar amount cashed-out last year was $63 billion. That seems like a really large number until we compare it to 2006, when homeowners cashed-out $321 billion. That is more than five times the current amount.

In 2006, people did use their homes as ATMs. They purchased new cars, boats, and lavish vacations. Today, the cashed-out equity is being used to consolidate debt, as seed capital for a new business, or to help a child with their college tuition.

Actual Headline: Consumer Debt hits $4 Trillion. Americans are diving deeper and deeper into debt.

The real story: The first sentence of the headline is accurate. The second sentence couldn’t be further from the truth. Total consumer debt is the highest it has ever been. That’s because the population continues to grow, and so does the economy (prices and wages).

The important number is how that total debt ranks as a percentage of disposable personal income. That percentage is the lowest ever recorded!! People are not “diving deeper and deeper into debt”.The exact opposite is true. They have less debt now than ever before.

Bottom Line

If you are thinking about buying or selling a home, it is important that you have a true professional handling your real estate needs. Someone who knows the truth about the current economy and its potential impact on the housing market.

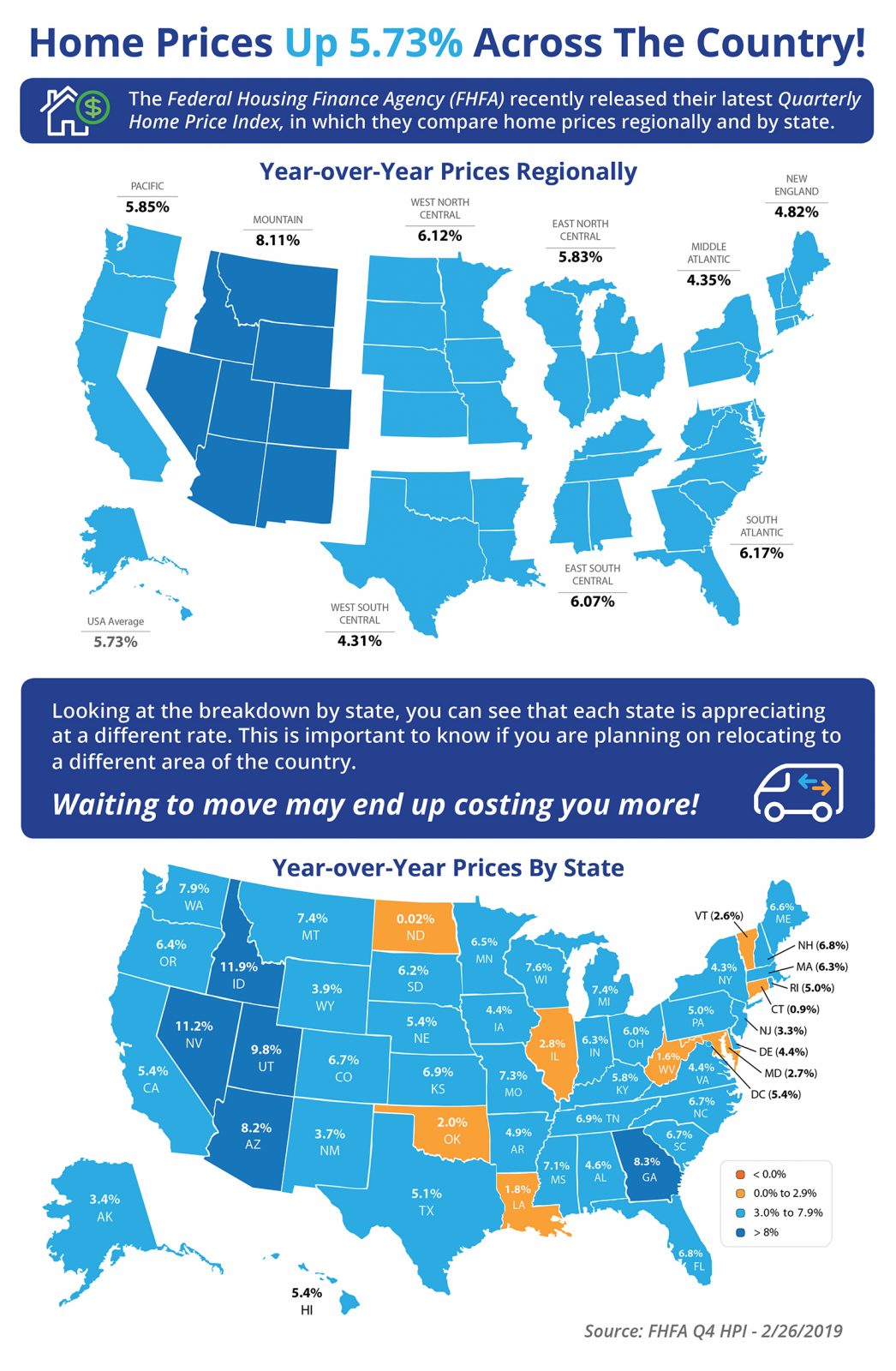

Home Prices Up 5.73% Across the Country! [INFOGRAPHIC]

Some Highlights:

- The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.

- In the report, home prices are compared both regionally and by state.

- Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!

No Worries… Home Prices Coming in for a SOFT Landing

Home prices have appreciated considerably over the last five years. This has some concerned that we may be in for another dramatic correction. However, recent statistics suggest home values will not crash as they did a decade ago. Instead, this time they will come in for a soft landing.

The previous housing market was fueled by an artificial demand created by mortgage standards that were far too lenient. When this demand was shut off, a flood of inventory came to market. This included heavily discounted distressed properties (foreclosures and short sales).

Today’s market is totally different. Mortgage standards are tighter than they were prior to the last boom and bust. There is no fear that a rush of foreclosures will come to market. The Mortgage Bankers’ Association just announced that foreclosures are lower today than at any time since 1996.

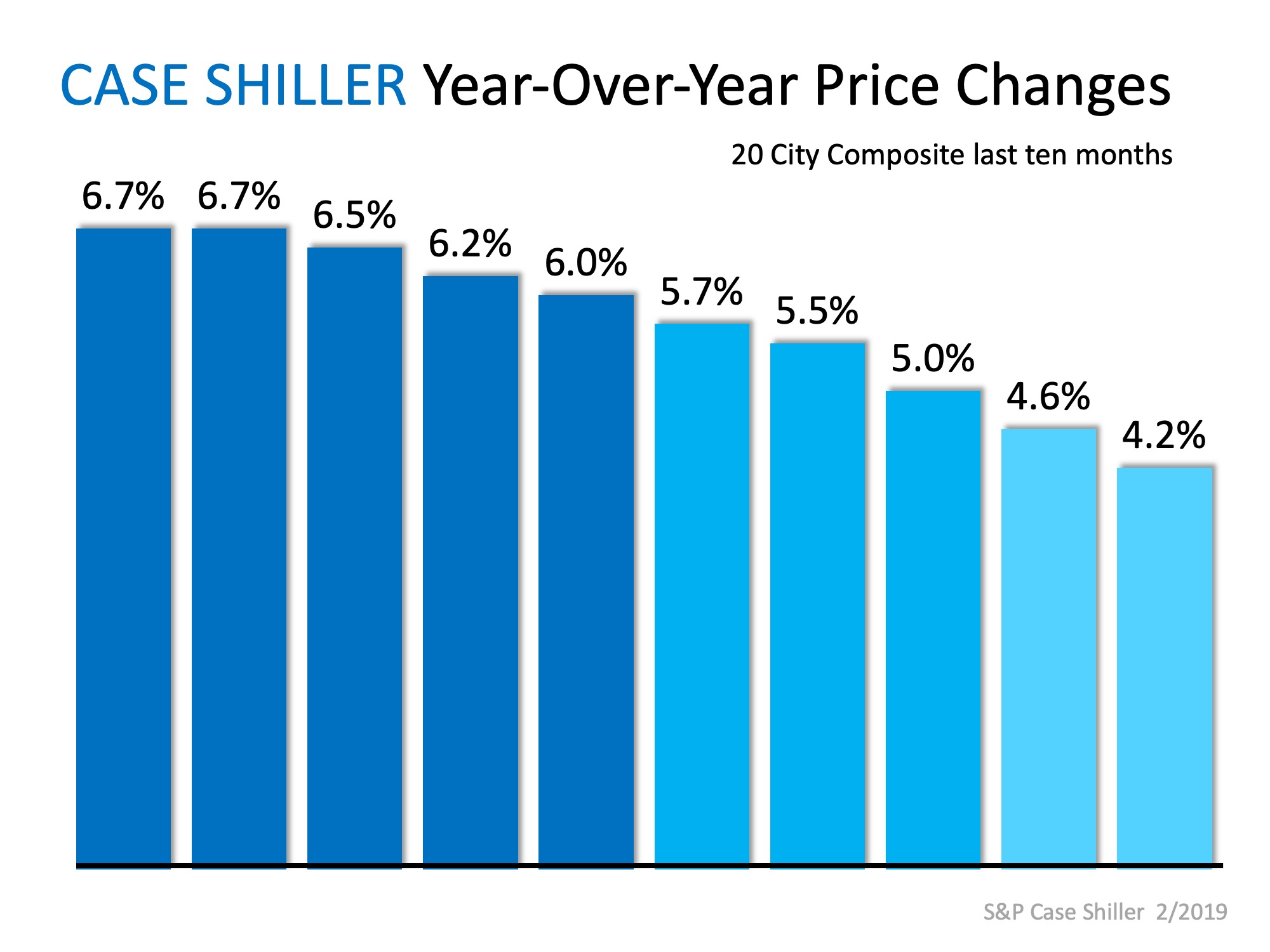

Case Shiller looks at the percentage of appreciation as compared to the same month the year prior. Here is a graph of their findings over the last ten months:

As we can see, home price appreciation is softening as more inventory comes to market. This shows that real estate prices are not crashing, but merely returning toward historic appreciation numbers of 3.6% annually.

Bottom Line

Home prices are leveling off. Long term, that is a good thing for the housing market.

The Cost of Buying a Home – A 50-Year Flashback

The interest rate you secure when buying your home impacts more than just your monthly mortgage payment. The higher the rate, the more money you will pay for your home over the course of your loan. Let’s get together to discuss how to get you in your dream home at today’s historically low rates! Call or Text (208) 919-3248 to get started today!